Will we see interest rates start to fall? If so, what impact will that have on the market? Why are investors selling out, and what does that mean for renters?

Here are seven questions facing the housing market in the year ahead.

Will the strong home price growth of 2023 persist?

Property price rises in 2023 were much stronger than most people expected.

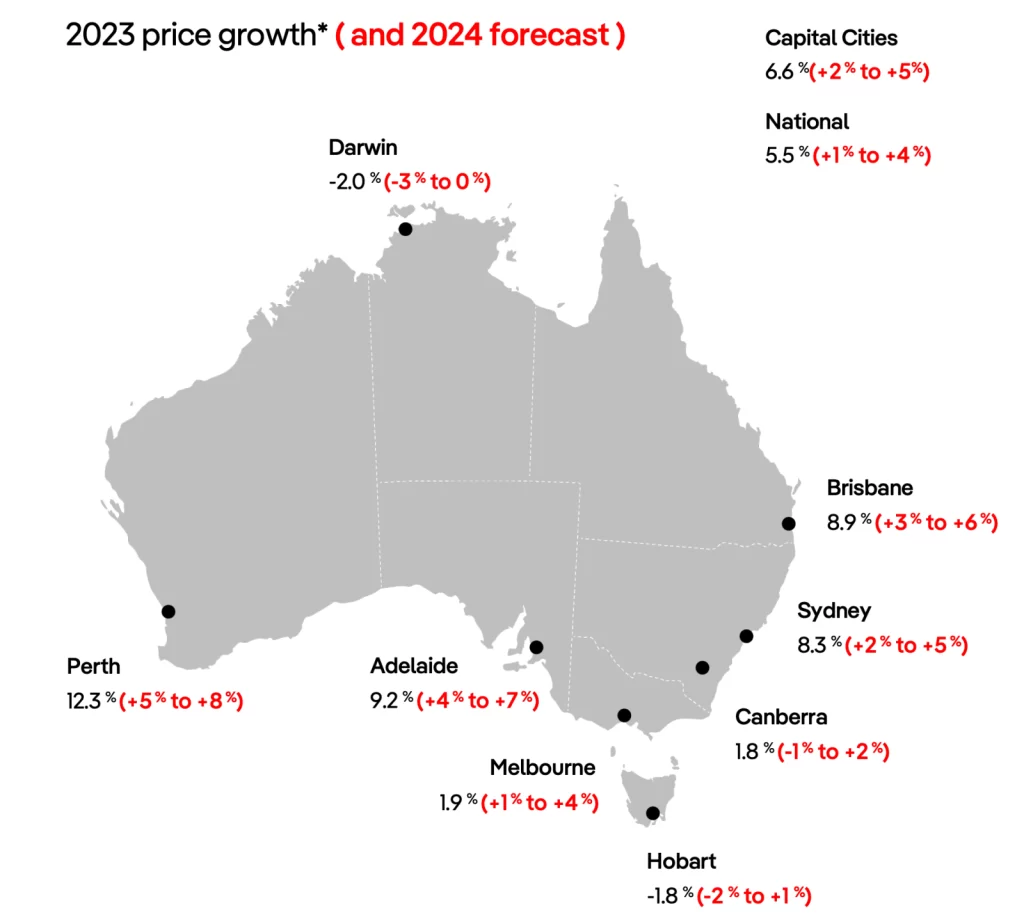

Considering the low sales volumes, weakening demand and falling prices that were evident in late 2022, it was expected that prices would fall further during the year. However, over the first 11 months of 2023, national property prices rose by 5.5%.

With the broader economy expected to slow and the unemployment rate anticipated to increase as the impact of 13 interest rate rises is felt, the rate of price growth will slow in 2024.

The latest PropTrack Property Market Outlook report forecasts national price growth of between 1% and 4% next year, with some capital cities expected to rise as much as 8%.

Note: 2023 price growth is year-to-date from January to November 2023 . Source: PropTrack

Prices are not expected to fall, due to the strong level of demand, lack of stock for sale, limited new housing stock and likely stable interest rate environment, but the pace of growth is expected to be slower than what we’ve seen in 2023.

Will interest rates fall and if so, when?

Since the first rate increase in May 2022, the cash rate has surged by 425 basis points, taking it from an historic low of 0.1% to a 12 year high of 4.35%.

With the increases in the cash rate to-date, borrowing capacity has fallen by around 30%.

Interest rate futures are currently pricing in no further increases and the expectation of a 25 basis point cut to rates by mid-2024.

Of course, the path of interest rates is unknown and difficult to forecast. While inflation remains outside of the target range, it seems unlikely that rates would be cut in the near term, and the chance of further rate hikes remains.

Will more vendors come to market?

Throughout 2023, the total number of properties for sale has remained at low levels the PropTrack Listings Report shows, as it has throughout recent years.

From the middle of the year there has been a large increase in the number of new listings that have come to market, however, this was largely driven by Sydney and Melbourne.

Other major capital cities have seen persistently low volumes of new listings.

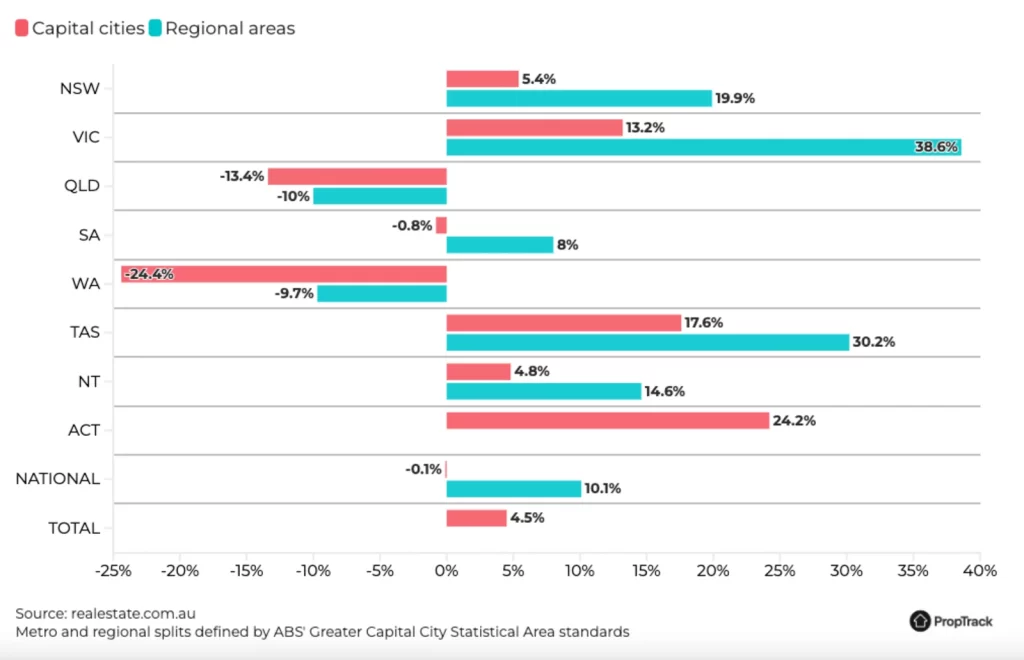

Year-on-year change in total listings on realestate.com.au

The big unknown for Sydney and Melbourne in 2024 is if the strength in new listings over the second half of 2023 will continue in 2024.

Elsewhere, it is about whether a meaningful increase to the low volume of stock for sale is on the horizon.

Is there going to be any relief for renters?

Rental price growth accelerated throughout 2023 as demand outstripped supply, leading to a lower rental vacancy rate and properties leasing quicker.

In some cities, advertised rents for units have increased by more than 20% over the past year. However, the gap between house and unit rents remains wider than it was pre-pandemic.

Rental growth has been fuelled by strong demand and the ongoing lack of supply which has been driven by a higher volume of investors selling compared to the number of new investors entering the market.

While it is difficult to imagine rents continuing to rise as rapidly as they have over the past year, it is also hard to see rents in the major capital cities doing anything but increase further in 2024.

Will new housing rebound as construction cost escalations ease?

New dwelling approvals are sitting at close to decade-low levels.

The increases in material and labour costs since the pandemic onset are well documented, but other factors are also at play. Higher interest costs on development and construction finance, along with higher mortgage costs for would-be buyers are also major impediments to new construction.

Construction material cost escalations are slowing, however labour shortages persist. The cost of new housing typically comes at a premium compared to existing homes but that premium is currently much larger than is typical and is discouraging people from buying new properties.

While we may see a moderate lift in new housing construction in 2024, it is hard to imagine a significant climb given the heightened material, labour and interest costs hampering the sector.

As investors leave the market, will new investors replace them?

Since the onset of the pandemic, a large number of investors have exited the market, and we continue to see a heightened volume of investor-owned properties listed for sale.

While some investors were exiting the market, new investors were returning to the market across 2023.

The likelihood of a more stable interest rate environment in 2024, the increase in tax-deductibility with interest rates at their highest level in 12 years and the ongoing increase in rental prices are expected to see property investment become a more attractive prospect in 2024, particularly as home price growth slows.

While it’s unlikely that enough investors will enter the market to offset those selling, we expect investor activity to strengthen throughout the year.

What will happen to first-home buyers?

Although the number of first-home buyers purchasing is well below the recent highs experienced during the pandemic, first-home buyer activity has lifted throughout 2023 and is above its long-term average.

In most instances, the cost of servicing a mortgage is going to be greater than renting. However, the state of the rental market is expected to drive more renters to want to purchase their own home, especially as mortgage rates stabilise.

Of course, only certain renters have the ability to transition to home ownership. However, the lure of cost certainty and the security that comes from owning your own home is expected to be an attractive prospect.

There are a number of assistance schemes available both at the federal and state level so don’t be surprised if first-home buying activity strengthens further in 2024.

Sourced from realestate.com